Pakistan

PM launches Economic Governance Reforms, says Pakistan exits economic firefighting phase

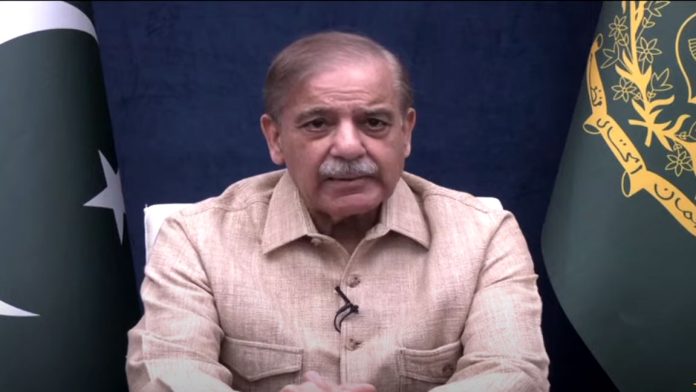

Islamabad: Prime Minister Shehbaz Sharif on Wednesday launched the government’s Economic Governance Reforms, declaring that Pakistan has moved out of the phase of economic firefighting after two years of politically difficult but structurally necessary decisions that restored macroeconomic stability and credibility.

Addressing the launch ceremony, the prime minister said the government inherited a severely strained economy in early 2024, marked by nearly 30 per cent inflation, critically low foreign exchange reserves, weakened state institutions and Pakistan’s marginalisation from global economic engagement. He said the gravity of the crisis left no room for populism or shortcuts.

Shehbaz Sharif said inflation had declined sharply from 29.2 per cent to 4.5 per cent, while foreign exchange reserves more than doubled from $9.2 billion to over $21 billion. He added that the current account position improved from a $3.3 billion deficit to a $1.9 billion surplus, with Pakistan moving from a primary deficit to a primary surplus and narrowing its overall fiscal deficit.

The prime minister said the government withdrew unsustainable subsidies, restored fiscal discipline, strengthened public financial management and initiated long-delayed privatisation reforms. “These were not cosmetic fixes but unavoidable structural reforms,” he said, adding that tough decisions were taken without sparing any political constituency.

He said revenue reforms were correcting long-standing distortions, with the tax-to-GDP ratio rising from around 8 per cent to over 10 per cent and more than one million new taxpayers brought into the formal economy. Tax collection grew by 26 per cent in 2025, supported by large-scale digitisation. He highlighted that the e-procurement platform ePADS now covers over 1,000 federal agencies and more than half a million contracts, integrated with FBR, NADRA and SECP systems.

The prime minister said the successful privatisation of Pakistan International Airlines and First Women Bank marked a break from decades of inaction, with further reforms of state-owned enterprises underway. He said Pakistan’s stabilisation and reform momentum had been acknowledged by international credit rating agencies and development partners.

“With macroeconomic indicators stabilised, our focus now shifts to accelerating growth, expanding exports and making Pakistan a far easier place to do business,” he said, adding that the reform agenda signalled a shift from crisis management to institution building.

Shehbaz Sharif said the Economic Governance Reforms comprise 142 actions, including 59 priority reforms and 83 complementary measures to be implemented by 58 institutions within defined timelines. Key focus areas include taxation, energy, privatisation, pensions, tariff rationalisation, regulatory simplification, rightsizing of the federal government and digital governance.

Earlier, Finance Minister Senator Muhammad Aurangzeb presented an overview of the reform framework and economic indicators. He said GDP growth reached 3.1 per cent in FY25 and accelerated to 3.71 per cent in the first quarter of FY26, while inflation remained around 5 per cent in the first five months of FY26 despite climate-related shocks.

Read More: PCB recalls Shaheen Afridi from BBL after sustaining injury

The finance minister said the tax-to-GDP ratio rose to 10.2 per cent in FY25, the highest in 25 years, while public debt declined to about 70 per cent of GDP from 75 per cent in FY23. He added that early debt repayments generated interest savings of Rs3.5 trillion and the policy rate had been reduced to 10.5 per cent from 22 per cent in June 2024.

On the external front, he said State Bank reserves reached $15.9 billion, remittances touched $38 billion in FY25 and the Pakistan Stock Exchange rose 52 per cent in dollar terms during 2025, reflecting renewed investor confidence.