Business

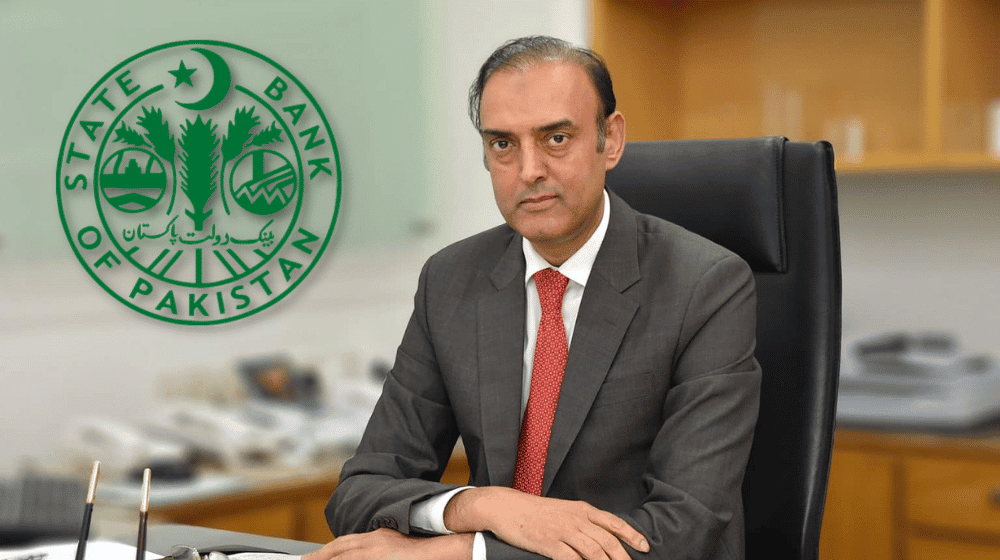

SBP Governor Praises Pakistan’s Economic Renaissance

State Bank of Pakistan (SBP) Governor Jameel Ahmad highlighted the broad-based decline in inflation due to monetary tightening, fiscal consolidation, eased import supplies, improved agriculture, and base effect.

Governor Ahmad engaged key international investors during events hosted by major global banks and financial firms on the sidelines of the IMF-World Bank Spring Meetings in Washington DC.

He shared Pakistan’s substantial macroeconomic improvement over the past year, driven by prudent monetary policy, fiscal consolidation, and the initiation of key structural reforms.

Inflation in Pakistan dropped significantly to a two-year low of 20.7 percent in March 2024 from a peak of 38 percent in May 2023, with core inflation decreasing to 15.7 percent in March.

The external sector stabilized, evidenced by a sharp reduction in the current account deficit (CAD) to $1 billion during Jul-Feb FY24 from $3.8 billion the previous year.

MUST READ

Yellen Warns of Global Economic Risks Amid Middle East Tensions

Improved agricultural output led to higher food exports and reduced import demand for commodities like wheat and cotton, further stabilizing the external account.

SBP’s foreign exchange reserves doubled from $3.1 billion in January 2023 to around $8 billion by April 12, 2024, despite significant repayments.

Forward liabilities of the SBP decreased from $5.7 billion in January 2023 to $3.4 billion in February 2024.

The SBP Governor Ahmad emphasized the positive changes in the country’s external debt dynamics, with reduced gross financing requirements and an improved maturity profile of external debt.

Inflows from overseas Pakistanis via Roshan Digital Accounts and other foreign investors increased, driven by successful attainment of targets under the IMF SBA program.

The government aims to sign a long-term IMF program to secure additional external financing and implement structural reforms.

SBP is focused on creating a conducive macroeconomic environment for private sector investment through its Strategic Plan 2028, targeting price and financial stability.

Digital technologies will address gaps in financial services access and revolutionize the domestic payments system, fostering sustainable economic growth.